The EU’s proposal to extend safeguard measures on imports of 26 steel product categories for another two years, until the end of June 2026, has caused concern among traders. This was discussed at the specialized event Eurometal Nordics, S&P Global reports.

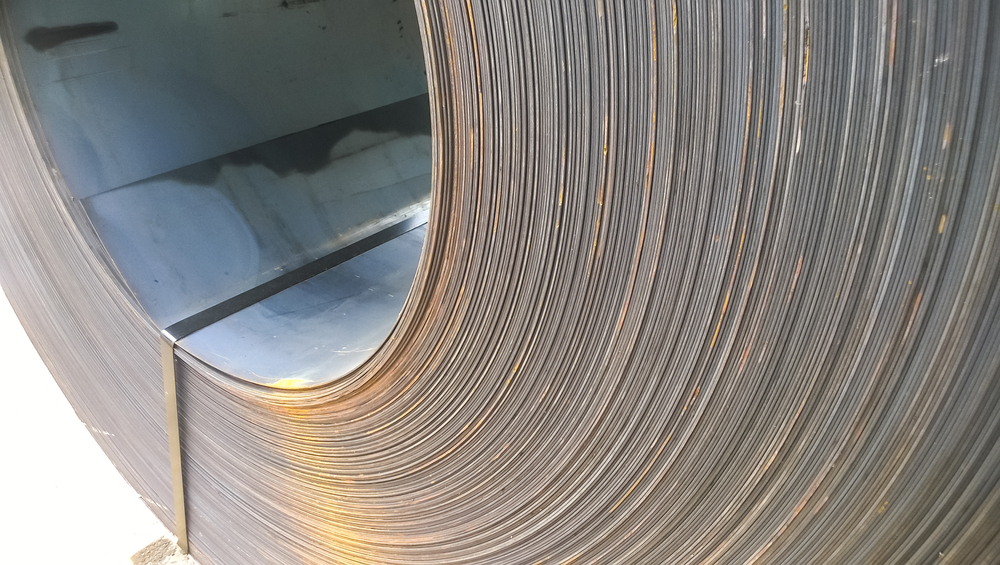

Market participants are particularly concerned about the proposal to impose a 15 percent restriction on imports of hot-rolled coils and wire rod within the quarterly quota in the «other countries» category for any individual country.

The planned restriction for any single exporter of hot-rolled plates will result in countries that traditionally supply large volumes of products to the EU being forced to reduce supplies or face duties.

One of the Finnish market participants on the sidelines of the event said that the industry is in talks with the government of their country, expressing concern about the extension of European protective measures, and the main issue is the 15% limit.

A representative of a large distribution company based in Spain told S&P Global that the fact that a 15% import restriction on hot-rolled coils is being proposed now, at short notice, without taking into account what material is in the ports, is not positive. He believes that the European Commission could have informed the market in advance so that its players could analyze the situation.

According to a source from a large British trading company, the new restrictions will generally help prices rise, but the price increase may negatively affect small traders.

A German trader said that the European steel industry needs protection to stabilize the negative market situation. However, the EC’s announcement did not lead to a price increase (HRC prices remained stable for a month), and sentiment did not improve either.

At the same time, Indian steelmakers, Kallanish writes, are concerned that the EU’s decision may result in an increase in HRC imports to the country due to the redirection of supplies from Southeast Asia (Vietnam, Japan, South Korea, and others). One market participant believes that these volumes could increase if Asian mills reduce prices further.

Indian steelmakers have previously pointed to an increase in imports from Asian countries. In May of this year, they warned of the potential impact on the market due to the increase in US tariffs on Chinese steel.

Alok Sahay, Secretary General of the Indian Steel Association (ISA), noted that last year, steel supplies from China and Japan had already increased. He added that given the fact that the country has not taken any protective measures over the past two years, this makes it vulnerable to “predatory” imports that will hamper ambitious plans to expand steel capacity.

In addition, in May, Vietnam’s Formosa Ha Tinh Steel received a license renewal from the Bureau of Indian Standards (BIS), increasing the number of foreign players in the Indian import market.

As GMK Center reported earlier, the European Union has officially notified the World Trade Organization that safeguard measures on steel imports will be extended for another two years, until the end of June 2026. The proposed changes to the safeguard measures are due to enter into force on July 1, 2024.